When buying property, one of the first decisions you’ll face is whether to invest in a leasehold or freehold property. Understanding the key differences between these two types of property ownership is crucial before making a decision. While both have their advantages and disadvantages, knowing which one aligns with your goals and lifestyle can save you from future complications. In this article, we will explore the differences between leasehold and freehold properties, their pros and cons, and what you should consider before buying.

What is Freehold Property?

Definition of Freehold

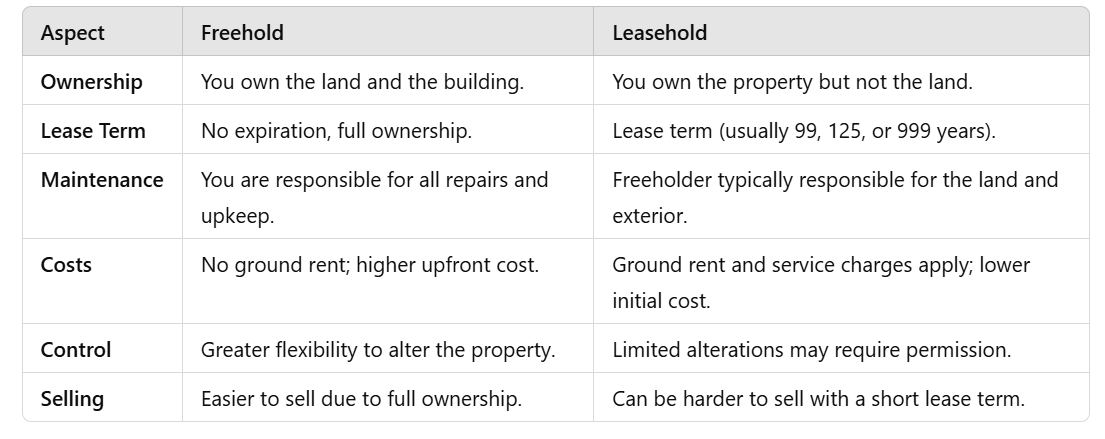

A freehold property means you own both the property and the land it sits on. As a freeholder, you have full control over the property for an unlimited period of time, and there is no expiration date on your ownership. Essentially, you’re free to modify, rent, or sell the property as you see fit, with minimal restrictions, subject to local laws.

Advantages of Freehold Properties:

- Complete Ownership: You own the land and the building, with no time limit on your ownership.

- Greater Control: You have more freedom to make alterations or improvements to the property.

- No Ground Rent: Since you own the land, you won’t need to pay annual ground rent, a common expense in leasehold properties.

- Easier to Sell: Freehold properties are often more attractive to buyers, making them easier to sell in the future.

Disadvantages of Freehold Properties:

- Higher Initial Cost: Freehold properties typically cost more upfront due to the land ownership.

- Maintenance Responsibility: As the freeholder, you are responsible for all repairs and upkeep of both the building and land, which can lead to higher ongoing maintenance costs.

What is Leasehold Property?

Definition of Leasehold

In a leasehold property, you own the property but not the land it sits on. The land is owned by the freeholder (also known as the landlord), and you purchase a lease from them that allows you to live in the property for a set period—often 99, 125, or 999 years. Once the lease term expires, ownership of the property typically reverts back to the freeholder unless the lease is extended.

Advantages of Leasehold Properties:

- Lower Purchase Price: Leasehold properties are usually less expensive than freehold ones, making them a more affordable option, especially in high-demand areas.

- Less Maintenance: In many cases, the freeholder is responsible for maintaining the land and building’s exterior, which can reduce the property owner’s maintenance burden.

- Long Lease Options: Some leases are very long (e.g., 999 years), making them virtually equivalent to freehold for practical purposes.

Disadvantages of Leasehold Properties:

- Limited Ownership: The biggest drawback is that you don’t own the land, and the lease has a finite duration. As the lease term shortens, the value of the property can decrease.

- Ground Rent and Fees: Leasehold owners often have to pay ground rent to the freeholder, and there may be additional service charges for maintenance and management of the property.

- Lease Expiry: When the lease term gets shorter (e.g., under 80 years), it can become more difficult to sell or remortgage the property. Extending a lease can be costly.

- Less Control Over Property: Leaseholders may need permission from the freeholder to make significant changes or alterations to the property.

Key Differences Between Leasehold and Freehold Properties

What to Consider When Buying a Leasehold Property

- Lease Length: Ensure the lease has a long enough duration. A lease with fewer than 80 years remaining can cause issues when selling or securing a mortgage.

- Ground Rent and Service Charges: Be aware of any ongoing costs such as ground rent or service charges, as these can increase over time.

- Lease Extensions: If you’re considering a leasehold property, check whether you can extend the lease. This may involve significant costs, especially if the lease is close to expiring.

- Permission for Alterations: If you plan to make changes to the property, find out whether the freeholder requires approval for renovations or modifications.

- Marketability: Understand how the length of the lease may affect the property’s future value and saleability.

Which Is Better: Leasehold or Freehold?

The decision between leasehold and freehold ultimately depends on your budget, long-term plans, and personal preferences.

- Choose Freehold if you want complete ownership and long-term control over your property. Freehold properties tend to offer more stability, fewer fees, and better potential for appreciation.

- Choose Leasehold if you’re looking for a more affordable option in a desirable area, or if you don’t mind paying ground rent and fees for the convenience of having someone else handle property maintenance.

Before making a decision, it’s important to understand the full terms of your agreement, whether leasehold or freehold, and seek professional advice if needed.

Both leasehold and freehold properties have their unique advantages and challenges. By understanding the key differences, you can make an informed choice that suits your needs, lifestyle, and financial situation. Whether you choose the security of freehold or the affordability of leasehold, careful consideration is essential when investing in property.

Looking to buy property? Consult with a real estate expert to explore your options, whether leasehold or freehold, and make sure your investment is the right one for you!