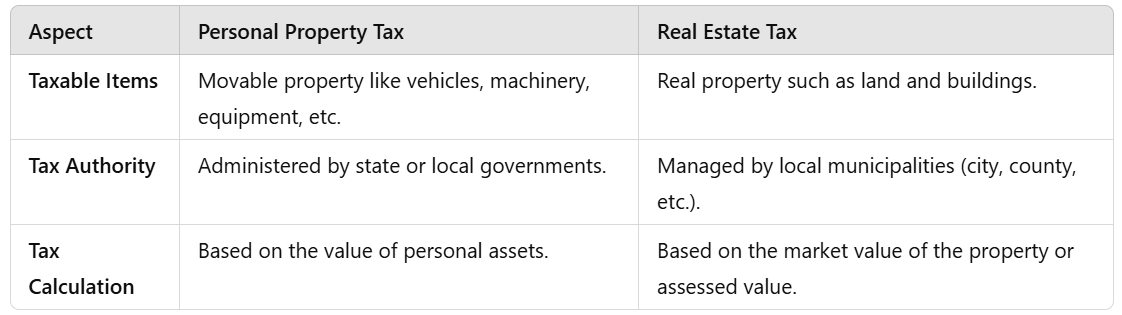

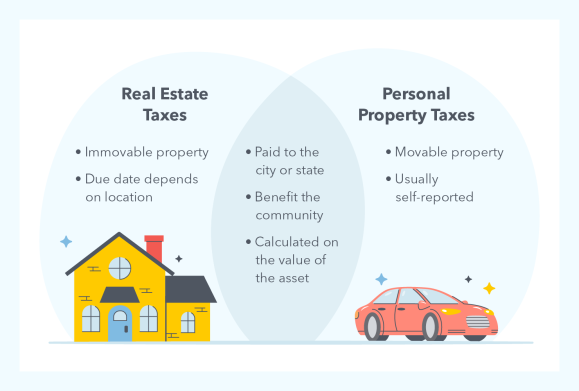

Property taxes concern property owners and fall into two main types: Personal Property Tax and Real Estate Tax. Both relate to property but differ in their impact on owners and their use. This article examines the key differences between personal property tax and real estate tax and explains their importance.

What is Personal Property Tax?

Personal Property Tax is imposed on movable property owned by individuals or businesses. Unlike Estate levy, which applies only to land and buildings, this tax covers tangible items such as cars, office machines, equipment, and other physical assets. Consequently, it plays a significant role in determining overall tax obligations.

What is Real Estate Tax?

Real Estate Tax, also known as property tax, is a property tax paid on the value of the land and buildings. It includes residential properties like houses and commercial property like offices and shopping centers. The tax is typically imposed on the appraised value of the property and is paid to the local authorities annually.

Significant Differences Between Personal Property Tax and Real Estate Tax

How Property Taxes Affect Owners of Property

If you own a car, business property, or other items of high worth, you likely will be subjected to personal property tax. However, if you own a dwelling or commercial building, you will be paying Estate levy. Both taxes will have a profound effect on your budgeting because they add up to your annual costs, and in some cases, can qualify as tax deductibles.

How to Manage Your Property Taxes

To effectively manage your property taxes, determine the correct value of your property to avoid overpayment. Additionally, claim available credits or deductions to reduce the tax burden, such as exemptions for specific property uses or tax relief schemes that local authorities offer.

Frequently Asked Questions (FAQ)

Q: Does Personal Property Tax include homes?

A: No, personal property tax includes mobile property like vehicles and equipment. Homes are taxed in real estate tax.

Q: Is Real Estate Tax reducible or deferrable?

A: Subject to local laws, some cities have property tax deferral schemes or exemptions for certain homeowners, for instance, elderly or veterans.

It is significant to know the distinction between personal property tax and real estate tax in order to properly handle your property and funds. If you are unsure how these taxes apply to you, consult a local tax expert who can guide you based on your specific situation.