Buying your first home is an exciting milestone, but it can also be overwhelming. With so many factors to consider, from choosing the right neighborhood to securing financing, it’s essential to be prepared. In this guide, we’ll walk you through essential tips for first-time homebuyers to make the process smoother and help you avoid common pitfalls.

1. Set a Realistic Budget

Before you start browsing listings, it’s crucial to set a clear and realistic budget. A budget will help you focus on homes within your price range and prevent you from falling in love with a property that’s out of reach. Consider factors like:

- Down payment: Most lenders require a down payment of 3% to 20% of the home’s purchase price.

- Monthly payments: Include your mortgage payment, property taxes, insurance, and potential homeowner association (HOA) fees.

- Additional costs: Don’t forget about maintenance, utilities, and home improvement projects.

Work with a financial advisor or mortgage broker to determine how much you can afford based on your income, debt, and other financial obligations.

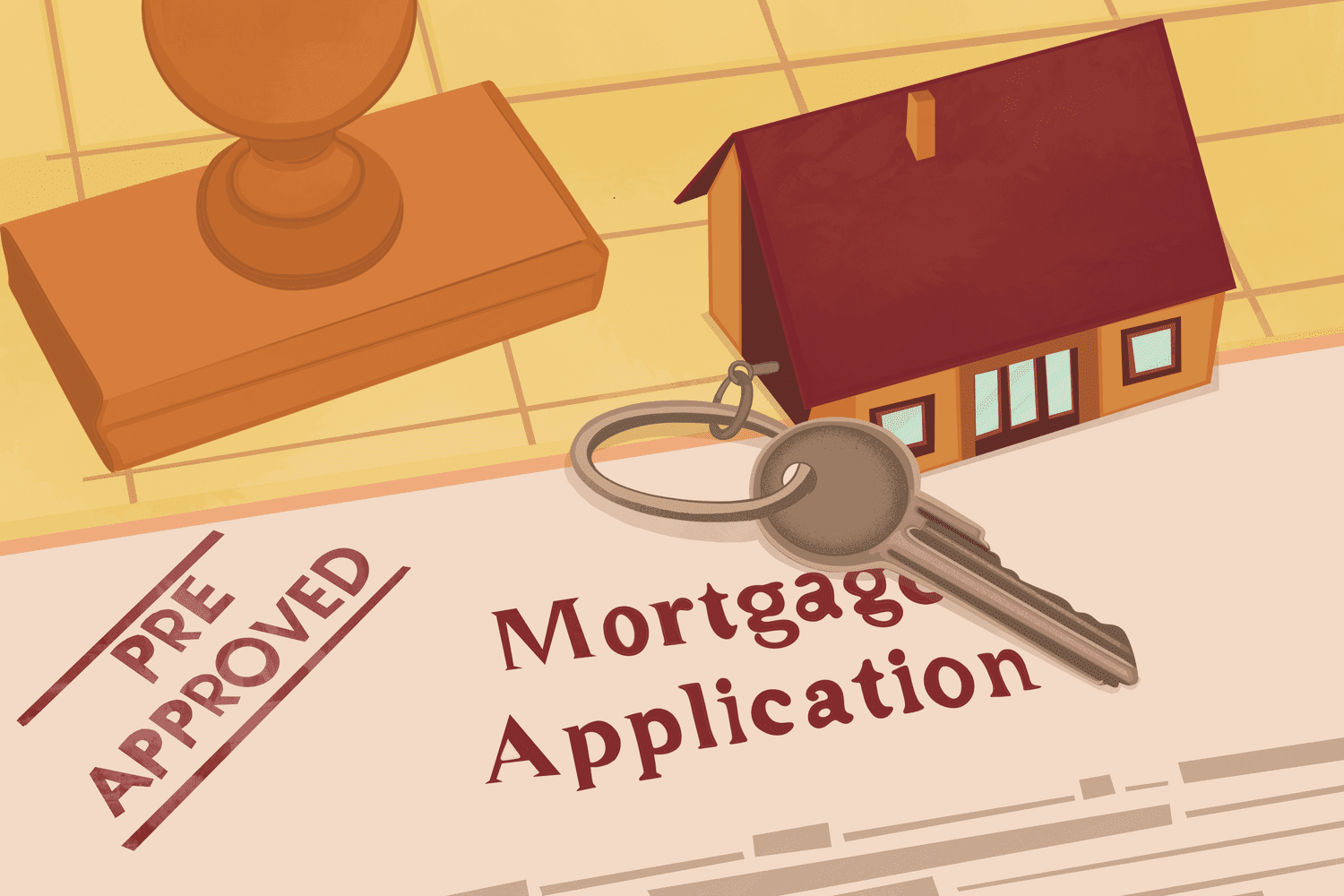

2. Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is one of the most important steps in the homebuying process. A pre-approval letter from a lender shows sellers that you are a serious buyer and that you have the financial backing to make an offer.

- Compare lenders: Shop around for the best interest rates and loan terms from different banks or lenders.

- Understand loan options: Choose between different mortgage options such as fixed-rate, adjustable-rate, or government-backed loans like FHA or VA loans.

- Know your credit score: A higher credit score can help you secure a lower interest rate, potentially saving you thousands of dollars over the life of the loan.

A pre-approval letter also helps you set a price range and ensures you don’t waste time looking at homes you can’t afford.

3. Research Neighborhoods and Location

Location is one of the most important factors in buying a home. Research different neighborhoods and consider aspects such as:

- Safety: Check crime rates in the area to ensure it’s a safe place to live.

- School districts: If you have or plan to have children, the quality of schools in the area can impact your decision.

- Accessibility: Consider the proximity to work, public transportation, grocery stores, parks, and other amenities.

- Future developments: Look into any upcoming projects that may affect the neighborhood, either positively or negatively.

Spending time researching different areas and visiting neighborhoods at various times of the day will help you find a location that fits your lifestyle.

4. Work with a Real Estate Agent

A skilled real estate agent can be an invaluable resource for first-time homebuyers. They will help you navigate the entire process, from finding properties to making an offer and negotiating the deal. Some benefits of working with a real estate agent include:

- Local expertise: Agents know the local market and can help you find properties that meet your needs and budget.

- Negotiation skills: An experienced agent will advocate for your best interests and help you negotiate the price and terms of the sale.

- Paperwork assistance: Real estate transactions involve a lot of paperwork, and an agent will guide you through all the legal documents and disclosures.

Be sure to choose an agent who specializes in working with first-time buyers and who understands your specific needs.

5. Don’t Skip the Home Inspection

A home inspection is an essential step in the homebuying process. It allows you to identify any hidden issues with the property before you commit to buying. While it’s an added cost, it’s worth it to avoid unexpected repairs down the road.

- Hire a qualified inspector: Choose a licensed and experienced home inspector to evaluate the property thoroughly.

- Focus on major issues: Pay attention to problems that can be costly, such as electrical, plumbing, foundation, or roof issues.

- Use the inspection report: If the inspection reveals significant problems, you can either ask the seller to fix them or negotiate the price down.

A home inspection can save you from making a costly mistake and gives you peace of mind knowing the condition of the property.

6. Understand Closing Costs

Closing costs are fees associated with finalizing the home purchase. These costs can add up to 3% to 6% of the home’s purchase price and are typically due at closing. Common closing costs include:

- Loan origination fees: Fees for processing your mortgage application.

- Appraisal fees: The cost of having the property appraised to determine its market value.

- Title insurance: Protects against potential issues with the title or ownership of the property.

- Attorney fees: In some states, you may need to hire an attorney for closing.

Make sure you budget for these additional costs so you’re not caught off guard during the final stages of the homebuying process.

7. Take Your Time and Don’t Rush the Process

The process of buying a home can be lengthy and may feel overwhelming at times, but it’s important not to rush. Take your time to:

- Evaluate your options: Don’t settle for the first property you see. Take the time to compare multiple homes and carefully consider your options.

- Make an informed decision: It’s essential to be 100% confident in your decision, as buying a home is a significant financial commitment.

- Be patient with negotiations: It’s normal for the negotiation process to take time. Be patient and work closely with your real estate agent to get the best deal.

8. Stay Within Your Budget

It’s easy to get excited when you find a home you love, but it’s important to remember your budget and long-term financial goals. Stick to your budget and avoid getting caught up in the emotions of homebuying. Stretching yourself financially could lead to stress and difficulties later on, so always prioritize your financial health.

Conclusion

Buying your first home is an exciting, life-changing experience, but it requires careful planning and research. By setting a realistic budget, getting pre-approved for a mortgage, researching neighborhoods, working with a trusted real estate agent, and taking your time, you can navigate the homebuying process with confidence. Stay informed, make thoughtful decisions, and soon you’ll be holding the keys to your very own home!